India's textile and clothing exports have witnessed a drop in the second quarter of FY 18-19 by 5.82% to US$ 8935.55 million over the previous quarter and 1.10% over the corresponding period of the last year (CPLY). The exports stakes from the overall T&C trade has also dropped by 2% in Q2 FY 18-19, now the T&C exports stakes 82% from the total T&C trade.

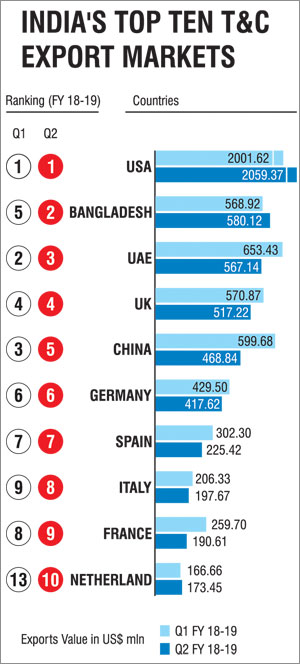

Knitted apparel is the major commodity exported from India to the world in Q2 FY 18-19. USA still remains the topmost export market for India's T&C goods, India exported goods worth of US$ 2059.37 million to USA in Q2 of FY 18-19. Surprisingly, knitted apparel has surpassed woven apparel exports in Q2 over the previous quarter. Knitwear exports totalled to US$ 1941.34 million with growth of 4.56% in Q2 FY 18-19 over the previous quarter, but the growth declined by 11.53% over the CPLY.

On an average, knitted apparel goods were traded at a price of US$ 0.31/piece in Q2 FY 18-19. In the knitted apparel segment, cotton t-shirt remained the most exported item from India. The export value in Q2 totalled to US$ 414.54 million, but perceived a negative growth both over the previous quarter and CPLY by 8.71% and 0.17% respectively and it stakes 21% share from the total knitted apparel exports in Q2. Indian traders exported cotton t-shirt at average price of US$ 0.41/piece in Q2, whereas in the previous quarter it was US$ 0.42/piece.

Knitted cotton nightdresses and pyjamas exports grew at a robust 58.76% to US$ 83.71 million in the Q2 FY 18-19 over the previous quarter, but compared to the CPLY the product has only jumped by 4.50%. This product was traded at an average price of US$ 0.28 per piece in Q2 FY18-19, whereas in the previous year it was US$ 0.31 and US$ 0.27 over CPLY.

Knitted babies garments made of cotton witnessed a negative trend in the second quarter by 3.34% and 4.06% over the previous quarter and CPLY totaling to US$ 153.60 million. Both cotton jerseys and cotton underpants / brief products have perceived a positive trend in exports. The products exports totalled to US$ 60.83 million and US$

55.28 million respectively in the Q2 FY 18-19.

Woven apparel exports have gone down drastically in Q2 FY 18-19. The commodity exports totalled to US$ 1731.83 million, a drop of 21.06% over the previous quarter and 16.87% over the CPLY. Men's cotton shirt is the top commodity in this segment, exports of which totalled to US$ 204.24 million, but the growth dropped marginally by 1.05% in Q2 over the previous quarter and 7.51% over the CPLY. Men's cotton shirt was traded at an average price of US$ 0.15 per piece in Q2 FY 18-19 and over the CPLY, whereas in the previous quarter the average price was US$ 0.16 per piece.Exports of dresses made from cotton and artificial fibre both have dropped significantly by 43.38% and 42.13% totalling US$ 75.20 million and US$ 42.71 million respectively in the Q2 of FY 18-19.Dresses made of cotton fibre were exported from India at average price of US$ 0.14 per piece in Q2, while in the previous quarter and CPLY the commodity was traded at average price of US$ 0.12 per piece. Dresses made of artificial fibre were traded at average price of US$ 0.12 per piece in Q2 and Q1 of FY 18-19, however over the CPLY of Q2 the average price was US$ 0.11 per piece.

Indian cotton exports also witnessed a downward trend in Q2 by 15.44% over the previous quarter, but witnessed a positive growth of 34.36% over the CPLY. Exports in Q2 totalled to US$ 1806.07 million. On average cotton was exported at a rate of US$ 0.48 per kg in Q2, whereas in the previous quarter it was US$ 0.51 per kg and in the CPLY it was US$ 0.52 per kg. Raw cotton exports have dropped by 50.83% to US$ 283.47 million in Q2 over the previous quarter. But over the CPLY, raw cotton exports have gone up by 199.11%. Raw cotton was shipped at US$ 0.34 per kg in Q2 FY 18-19, while in the previous quarter it was US$ 0.56 per kg.

Carpet and other textile floor coverings have marginally done well in the Q2 of this fiscal year. The commodity perceived a growth of 1.05% in the Q2 FY 18-19 totalling to US$ 425.12 million over the previous quarter. However the products witnessed a fall over the CPLY by 6.27%.

Knitted fabrics exports dropped by 5.46% to US$ 100.16 million in Q2 FY 18-19, whereas compared to the CPLY exports shot up by 23.08%. Man-made filament yarn exports fell15.44% to US$ 1806.07 million in Q2 FY 18-19 over the previous quarter, while compared to CPLY, exports of MMF rose by 34.36%. Man-made staple fibre exports too registered a decline compared to both the previous quarter and CPLY by 3.60% and 7.79% with the exports totalling to US$ 481.89 million in the Q2 FY 18-19. A special woven fabric commodity has seen a slight increase of 0.53% in the Q2 FY 18-19 totalling to US$ 96.50 million.

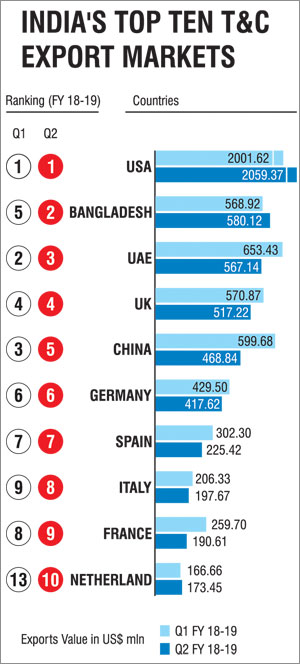

India's T&C Export Markets

USA remains largest buyer of Indian T&C goods

Country-wise, United States of America (USA) remains the largest export market for India's textile and clothing goods. In the second quarter of FY 18-19, exports to USA totalled to US$ 2059.37 million with a growth of 2.89% and stakes 23% in the India's T&C exports to USA.In USA, India's apparel exports are ruling the basket with a stake of 47% from the total T&C exports to USA. India's apparel exports to the USA during the quarter totalled US$ 969.72 million in Q2 FY 18-19, but witnessed a drop of 6.79% over the previous quarter and 0.44% over the CPLY.

High cotton imports make Bangladesh second largest export market for India

Though T&C exports to Bangladesh have not increased much in Q2 compared to the previous quarters, still the country has managed to be the second largest export market for India's T&C goods, mainly due to increased exports of cotton.

In the first quarter of FY 18-19, Bangladesh was the 5th largest export market of India's T&C goods. India's T&C exports to Bangladesh have increased by 1.97% over the previous quarter and 55.41% over CPLY in Q2 FY 18-19, with exports totalling to US$ 580.12 million. India has exported cotton the most to Bangladesh in the second quarter and exports totalled to US$ 475.21 million with a growth of 8.04% over previous quarter and 68.63% over the CPLY.

Cotton commodity stakes 82% share from the total T&C exports of India's to Bangladesh in Q2 FY 19-18.

Exports of man-made filaments have dropped by 23.34% to US$ 26.49 million in Q2 over the previous quarter, while it has witnessed a growth of 43.77% over CPLY. Knitted fabrics too have perceived a negative growth of 5.34% in the Q2 to US$ 16.14 over the previous quarter, but witnessed an increase of 46.73% over CPLY.

Exports to UAE continue to fall

U.A.E which was the second largest export market for India's T&C goods in the first quarter of this fiscal year, has witnessed a drop in its T&C imports from India in Q2. India's exports to UAE totalled to US$ 567.14 million with negative growth of 13.21% over the previous quarter and 40.94% over CPLY. Currently U.A.E is the third largest export market for India's T&C goods. Knitted apparel is the major commodity exported to U.A.E from the country, with an export value of US$ 252.12 million in Q2 FY 18-19. But the growth of knitted apparel dropped by 7.48% over the previous quarter and 44.15% over CPLY.

Even woven apparel exports which is the second largest export commodity to the U.A.E has witnessed a drop both over the previous quarter and CPLY by 22.63% and 48.84% respectively.Cotton exports fell by 21% and 20.91% over the previous quarter and CPLY respectively, with exports totalling to US$ 14.45 million in Q2 FY 18-19.

Exports to UK fall too

United Kingdom remains the fourth largest export market for India's T&C good. Exports to UK totalled to US$ 517.22 million in Q2, but have perceived a negative growth of 9.40% over the previous quarter and 9.46% over CPLY. Knitted apparel is ruling the basket with share of 41% from the total T&C export to UK. The exports of knitted apparel totalled to US$ 213.99 million with a growth of 10.07% in Q2 FY 18-19 over the previous quarter, but perceived a negative growth of 13.64% over CPLY. Woven apparel exports have dropped by 35.68% in Q2 over the previous quarter and 14.99% over CPLY. Carpets and other textile floor covering have also witnessed a drop by 2.53% in Q2 over the previous quarter and 6.57% over CPLY. India's cotton exports to UK have witnessed a rise of 22% in Q2 totaling to US$ 6.6 million over the previous quarter and 13.79% over CPLY.

Cotton exports to China rose 76.32%

India's T&C exports to China fell in Q2 FY 18-19, with negative growth of 22.49% to US$ 464.84 million over the previous quarter, while over the CPLY, the country has witnessed a positive growth of 49.75%. Cotton is the major commodity exported from India to China, exports totalled to US$ 369.91 million in Q2 FY 18-19. But the commodity perceived a negative growth of 24.72% over the previous quarter, while over the CPLY the growth rose by 76.32%.Apparel exports to China in Q2 have dropped by 26.25% to US$ 18.74 million over the previous quarter, but perceived a positive growth of 31.88% over the CPLY.

India struggles in other traditional European markets

India's T&C exports to Germany, Spain, Italy and France have dropped in Q2 FY 18-19. Exports to Germany totalled to US$ 417.62 million with a negative growth of 2.77% over the previous quarter and 7.48% over the CPLY. Exports to Spain totalled to US$ 225.42 million with downward growth of 25.43% over the previous quarter and 14.63% over CPLY. Exports to Italy dropped by 4.20% in the Q2 FY 18-19 with an export value of US$ 197.67 million over the previous quarter, while over the CPLY the exports dropped by 4.78%. Exports to France dropped by 26.60% to US$ 190.61 million in Q2 FY 18-19 over the previous quarter and 5.02% over CPLY.

Netherland is now the tenth largest T&C export market for India. In the last quarter (Q1 FY 19-18), the country was the thirteenth largest one. Indian exporters have shown a keen interest in exporting T&C goods to the Netherlands. Exports totalled to US$ 173.45 million in Q2 FY 18-19 with a growth of 4.07% over the previous quarter and 17.05% over the CPLY. Demands of knitted apparel have increased from Netherlands; Indian exporters have exported knitted apparel goods of worth US$ 70.46 million in Q2 with growth of 30.02% over the previous quarter and 33.52% over CPLY. Woven apparel exports have witnessed a drop of 20.89% to US$ 44.03 in Q2 over the previous quarter. Even exports of carpets and other textile floor covering have witnessed a drop of 21.65% to US$ 6.95 over the previous quarter. Cotton exports have gone marginally down by 11.61% to US$ 2.36 million in Q2 over the previous quarter.

Country-wise, United States of America (USA) remains the largest export market for India's textile and clothing goods. In the second quarter of FY 18-19, exports to USA totalled to US$ 2059.37 million with a growth of 2.89% and stakes 23% in the India's T&C exports to USA.In USA, India's apparel exports are ruling the basket with a stake of 47% from the total T&C exports to USA. India's apparel exports to the USA during the quarter totalled US$ 969.72 million in Q2 FY 18-19, but witnessed a drop of 6.79% over the previous quarter and 0.44% over the CPLY.

High cotton imports make Bangladesh second largest export market for India

Though T&C exports to Bangladesh have not increased much in Q2 compared to the previous quarters, still the country has managed to be the second largest export market for India's T&C goods, mainly due to increased exports of cotton.

In the first quarter of FY 18-19, Bangladesh was the 5th largest export market of India's T&C goods. India's T&C exports to Bangladesh have increased by 1.97% over the previous quarter and 55.41% over CPLY in Q2 FY 18-19, with exports totalling to US$ 580.12 million. India has exported cotton the most to Bangladesh in the second quarter and exports totalled to US$ 475.21 million with a growth of 8.04% over previous quarter and 68.63% over the CPLY.

Cotton commodity stakes 82% share from the total T&C exports of India's to Bangladesh in Q2 FY 19-18.

Exports of man-made filaments have dropped by 23.34% to US$ 26.49 million in Q2 over the previous quarter, while it has witnessed a growth of 43.77% over CPLY. Knitted fabrics too have perceived a negative growth of 5.34% in the Q2 to US$ 16.14 over the previous quarter, but witnessed an increase of 46.73% over CPLY.

Exports to UAE continue to fall

U.A.E which was the second largest export market for India's T&C goods in the first quarter of this fiscal year, has witnessed a drop in its T&C imports from India in Q2. India's exports to UAE totalled to US$ 567.14 million with negative growth of 13.21% over the previous quarter and 40.94% over CPLY. Currently U.A.E is the third largest export market for India's T&C goods. Knitted apparel is the major commodity exported to U.A.E from the country, with an export value of US$ 252.12 million in Q2 FY 18-19. But the growth of knitted apparel dropped by 7.48% over the previous quarter and 44.15% over CPLY.

Even woven apparel exports which is the second largest export commodity to the U.A.E has witnessed a drop both over the previous quarter and CPLY by 22.63% and 48.84% respectively.Cotton exports fell by 21% and 20.91% over the previous quarter and CPLY respectively, with exports totalling to US$ 14.45 million in Q2 FY 18-19.

Exports to UK fall too

United Kingdom remains the fourth largest export market for India's T&C good. Exports to UK totalled to US$ 517.22 million in Q2, but have perceived a negative growth of 9.40% over the previous quarter and 9.46% over CPLY. Knitted apparel is ruling the basket with share of 41% from the total T&C export to UK. The exports of knitted apparel totalled to US$ 213.99 million with a growth of 10.07% in Q2 FY 18-19 over the previous quarter, but perceived a negative growth of 13.64% over CPLY. Woven apparel exports have dropped by 35.68% in Q2 over the previous quarter and 14.99% over CPLY. Carpets and other textile floor covering have also witnessed a drop by 2.53% in Q2 over the previous quarter and 6.57% over CPLY. India's cotton exports to UK have witnessed a rise of 22% in Q2 totaling to US$ 6.6 million over the previous quarter and 13.79% over CPLY.

Cotton exports to China rose 76.32%

India's T&C exports to China fell in Q2 FY 18-19, with negative growth of 22.49% to US$ 464.84 million over the previous quarter, while over the CPLY, the country has witnessed a positive growth of 49.75%. Cotton is the major commodity exported from India to China, exports totalled to US$ 369.91 million in Q2 FY 18-19. But the commodity perceived a negative growth of 24.72% over the previous quarter, while over the CPLY the growth rose by 76.32%.Apparel exports to China in Q2 have dropped by 26.25% to US$ 18.74 million over the previous quarter, but perceived a positive growth of 31.88% over the CPLY.

India struggles in other traditional European markets

India's T&C exports to Germany, Spain, Italy and France have dropped in Q2 FY 18-19. Exports to Germany totalled to US$ 417.62 million with a negative growth of 2.77% over the previous quarter and 7.48% over the CPLY. Exports to Spain totalled to US$ 225.42 million with downward growth of 25.43% over the previous quarter and 14.63% over CPLY. Exports to Italy dropped by 4.20% in the Q2 FY 18-19 with an export value of US$ 197.67 million over the previous quarter, while over the CPLY the exports dropped by 4.78%. Exports to France dropped by 26.60% to US$ 190.61 million in Q2 FY 18-19 over the previous quarter and 5.02% over CPLY.

Netherland is now the tenth largest T&C export market for India. In the last quarter (Q1 FY 19-18), the country was the thirteenth largest one. Indian exporters have shown a keen interest in exporting T&C goods to the Netherlands. Exports totalled to US$ 173.45 million in Q2 FY 18-19 with a growth of 4.07% over the previous quarter and 17.05% over the CPLY. Demands of knitted apparel have increased from Netherlands; Indian exporters have exported knitted apparel goods of worth US$ 70.46 million in Q2 with growth of 30.02% over the previous quarter and 33.52% over CPLY. Woven apparel exports have witnessed a drop of 20.89% to US$ 44.03 in Q2 over the previous quarter. Even exports of carpets and other textile floor covering have witnessed a drop of 21.65% to US$ 6.95 over the previous quarter. Cotton exports have gone marginally down by 11.61% to US$ 2.36 million in Q2 over the previous quarter.

Country-wise, United States of America (USA) remains the largest export market for India's textile and clothing goods. In the second quarter of FY 18-19, exports to USA totalled to US$ 2059.37 million with a growth of 2.89% and stakes 23% in the India's T&C exports to USA.In USA, India's apparel exports are ruling the basket with a stake of 47% from the total T&C exports to USA. India's apparel exports to the USA during the quarter totalled US$ 969.72 million in Q2 FY 18-19, but witnessed a drop of 6.79% over the previous quarter and 0.44% over the CPLY.

High cotton imports make Bangladesh second largest export market for India

Though T&C exports to Bangladesh have not increased much in Q2 compared to the previous quarters, still the country has managed to be the second largest export market for India's T&C goods, mainly due to increased exports of cotton.

In the first quarter of FY 18-19, Bangladesh was the 5th largest export market of India's T&C goods. India's T&C exports to Bangladesh have increased by 1.97% over the previous quarter and 55.41% over CPLY in Q2 FY 18-19, with exports totalling to US$ 580.12 million. India has exported cotton the most to Bangladesh in the second quarter and exports totalled to US$ 475.21 million with a growth of 8.04% over previous quarter and 68.63% over the CPLY.

Cotton commodity stakes 82% share from the total T&C exports of India's to Bangladesh in Q2 FY 19-18.

Exports of man-made filaments have dropped by 23.34% to US$ 26.49 million in Q2 over the previous quarter, while it has witnessed a growth of 43.77% over CPLY. Knitted fabrics too have perceived a negative growth of 5.34% in the Q2 to US$ 16.14 over the previous quarter, but witnessed an increase of 46.73% over CPLY.

Exports to UAE continue to fall

U.A.E which was the second largest export market for India's T&C goods in the first quarter of this fiscal year, has witnessed a drop in its T&C imports from India in Q2. India's exports to UAE totalled to US$ 567.14 million with negative growth of 13.21% over the previous quarter and 40.94% over CPLY. Currently U.A.E is the third largest export market for India's T&C goods. Knitted apparel is the major commodity exported to U.A.E from the country, with an export value of US$ 252.12 million in Q2 FY 18-19. But the growth of knitted apparel dropped by 7.48% over the previous quarter and 44.15% over CPLY.

Even woven apparel exports which is the second largest export commodity to the U.A.E has witnessed a drop both over the previous quarter and CPLY by 22.63% and 48.84% respectively.Cotton exports fell by 21% and 20.91% over the previous quarter and CPLY respectively, with exports totalling to US$ 14.45 million in Q2 FY 18-19.

Exports to UK fall too

United Kingdom remains the fourth largest export market for India's T&C good. Exports to UK totalled to US$ 517.22 million in Q2, but have perceived a negative growth of 9.40% over the previous quarter and 9.46% over CPLY. Knitted apparel is ruling the basket with share of 41% from the total T&C export to UK. The exports of knitted apparel totalled to US$ 213.99 million with a growth of 10.07% in Q2 FY 18-19 over the previous quarter, but perceived a negative growth of 13.64% over CPLY. Woven apparel exports have dropped by 35.68% in Q2 over the previous quarter and 14.99% over CPLY. Carpets and other textile floor covering have also witnessed a drop by 2.53% in Q2 over the previous quarter and 6.57% over CPLY. India's cotton exports to UK have witnessed a rise of 22% in Q2 totaling to US$ 6.6 million over the previous quarter and 13.79% over CPLY.

Cotton exports to China rose 76.32%

India's T&C exports to China fell in Q2 FY 18-19, with negative growth of 22.49% to US$ 464.84 million over the previous quarter, while over the CPLY, the country has witnessed a positive growth of 49.75%. Cotton is the major commodity exported from India to China, exports totalled to US$ 369.91 million in Q2 FY 18-19. But the commodity perceived a negative growth of 24.72% over the previous quarter, while over the CPLY the growth rose by 76.32%.Apparel exports to China in Q2 have dropped by 26.25% to US$ 18.74 million over the previous quarter, but perceived a positive growth of 31.88% over the CPLY.

India struggles in other traditional European markets

India's T&C exports to Germany, Spain, Italy and France have dropped in Q2 FY 18-19. Exports to Germany totalled to US$ 417.62 million with a negative growth of 2.77% over the previous quarter and 7.48% over the CPLY. Exports to Spain totalled to US$ 225.42 million with downward growth of 25.43% over the previous quarter and 14.63% over CPLY. Exports to Italy dropped by 4.20% in the Q2 FY 18-19 with an export value of US$ 197.67 million over the previous quarter, while over the CPLY the exports dropped by 4.78%. Exports to France dropped by 26.60% to US$ 190.61 million in Q2 FY 18-19 over the previous quarter and 5.02% over CPLY.

Netherland is now the tenth largest T&C export market for India. In the last quarter (Q1 FY 19-18), the country was the thirteenth largest one. Indian exporters have shown a keen interest in exporting T&C goods to the Netherlands. Exports totalled to US$ 173.45 million in Q2 FY 18-19 with a growth of 4.07% over the previous quarter and 17.05% over the CPLY. Demands of knitted apparel have increased from Netherlands; Indian exporters have exported knitted apparel goods of worth US$ 70.46 million in Q2 with growth of 30.02% over the previous quarter and 33.52% over CPLY. Woven apparel exports have witnessed a drop of 20.89% to US$ 44.03 in Q2 over the previous quarter. Even exports of carpets and other textile floor covering have witnessed a drop of 21.65% to US$ 6.95 over the previous quarter. Cotton exports have gone marginally down by 11.61% to US$ 2.36 million in Q2 over the previous quarter.

textileexcellence

textileexcellence